PredictIt Lifts Restrict on Political Trades in New CFTC Settlement

- Prediction market operator boosts contract restrict to $3,500

- Scraps restrict on variety of merchants per contract

Prediction markets operator PredictIt introduced Tuesday it reached a brand new settlement with the Commodities Futures Buying and selling Fee (CFTC), paving the best way for the corporate to extend liquidity and supply increased political contract limits.

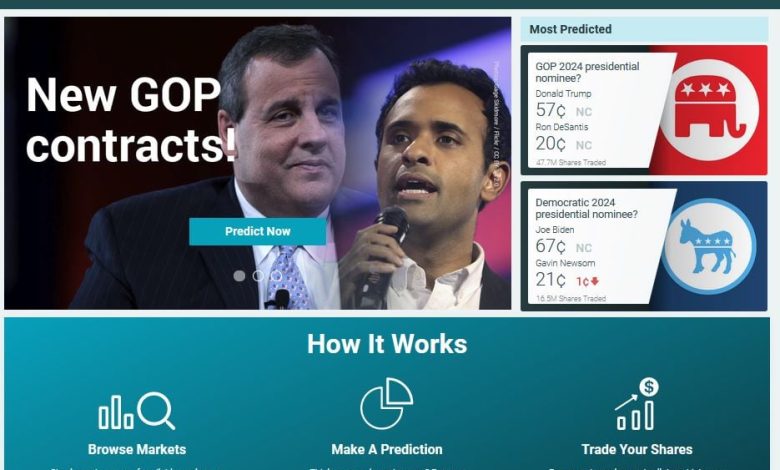

A display seize of PredictIt’s residence web page on July 24, 2023. The corporate mentioned it’s lifting its contract restrict. (Picture: PredictIt)

PredictIt, which rose to prominence by providing derivatives on elections, mentioned that following the brand new accord with the CFTC, the earlier contract restrict of $850 per shopper has been elevated to $3,500 — the federal particular person marketing campaign contribution restrict. The Washington, DC-based firm added its earlier restrict of 5,000 merchants per occasion contract has been lifted. Now, there is no such thing as a cap, which might end in elevated liquidity throughout numerous politically based mostly occasion contracts. The information comes after PredictIt was on a regulatory hiatus.

With strengthened compliance protocols and an unwavering dedication to excellence, PredictIt returns from its regulatory pause not simply as a pacesetter — however because the benchmark for what real-money prediction markets can and needs to be,” according to a post on the corporate’s website.

Whereas PredictIt has encountered regulatory headwinds, it’s largely steered away from the sports activities betting maelstrom surrounding rivals corresponding to Kalshi and Polymarket. Kalshi, specifically, is within the crosshairs of a number of attorneys common as a result of it’s providing sports activities occasion contracts whereas not holding state gaming licenses. The corporate believes it could accomplish that as a result of it’s federally regulated.

PredictIt, CFTC Not too long ago Settled Litigation

Information of PredictIt’s expanded limits arrives about three weeks after the corporate settled long-running litigation with the CFTC. In 2014, the fee granted PredictIt approval to supply political derivatives with out concern of enforcement motion.

Eight years later, that approval was rescinded and the CFTC gave the prediction markets operator till February 2023 to liquidate excellent contracts. PredictIt challenged that call in courtroom, touching off a prolonged authorized tussle.

In what could possibly be the newest sign of a extra favorable regulatory regime for prediction market companies, the CFTC/PredictIt case has been put to relaxation, opening the door for the aforementioned contract restrict enhance and, probably, enhanced liquidity.

“The events have reached an settlement in precept that might resolve this litigation. Within the coming days, the events will likely be making filings asking the Courtroom to enter orders implementing that decision. Till such time, the events respectfully request that the Courtroom proceed to remain the pending motions,” in keeping with a June submitting with the US District Courtroom for the Western District of Texas.

PredictIt Concentrating on Extra Markets

Along with unveiling increased contract limits, PredictIt teased an expanded slate of futures contracts for merchants to guage.

We’re dramatically increasing the quantity and variety of markets accessible — giving merchants much more methods to have interaction with breaking information, coverage shifts, and electoral dynamics in actual time,” in keeping with the submit.

That means PredictIt has realized from Kalshi’s sports activities betting-related points and can stay targeted on political derivatives. Of the 25 markets at the moment accessible on PredictIt, all are associated to politics, with essentially the most closely traded pertaining to the New York Metropolis mayoral contest.