Pennsylvania Ability Sport Developer Opposes Invoice’s Tax Price

- One other invoice to manage talent video games in Pennsylvania has been launched

- Ability video games are slot-like gaming machines that embody components of talent

- A participant’s play can affect the payout charge

New laws in Pennsylvania to legalize and tax controversial talent video games was filed this week within the Harrisburg capital. The main developer of the slot-like gaming terminals within the commonwealth instantly opposed the invoice on claims that it seeks to implement too nice a tax.

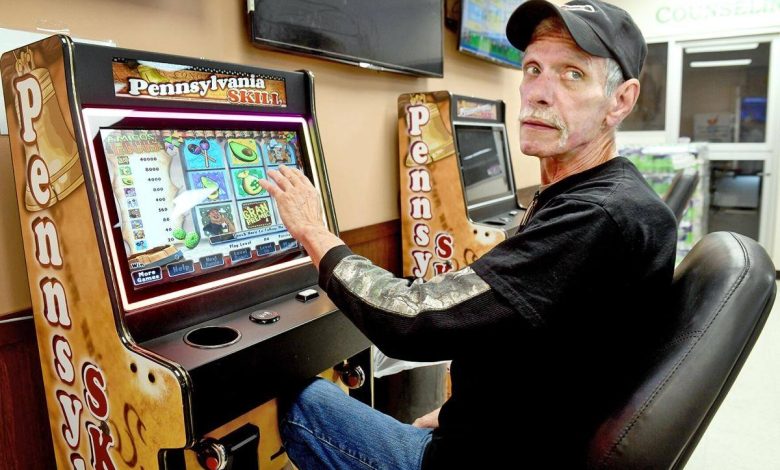

A person performs a Pennsylvania Ability sport inside a grocery retailer. One other invoice searching for to legalize, regulate, and tax talent video games in Pennsylvania has been filed. (Picture: Shutterstock)

A gaggle of 5 Senate Republicans filed Senate Invoice 756, an act to amend Title 4 (Amusements) to create a regulatory framework for talent video games. The laws comes from Sens. Dan Laughlin (R-Erie), Rosemary Brown (R-Monroe), Joe Pittman (R-Indiana), Kim Ward (R-Westmoreland), and Chris Gebhard (R-Lancaster). Pittman is almost all ground chief.

SB756 would enable companies possessing a liquor license from the Pennsylvania Liquor Management Board to deal with as much as 4 talent gaming machines. Eating places with alcohol privileges would have the ability to provide two machines. The laws would moreover enable VGT truck stops to extend their variety of the slot-like machines from 5 to seven.

Ability video games are just like slots however proponents of the machines say they don’t fall beneath the regulatory scope of the Gaming Act as a result of their payout charges can as a substitute be altered by a participant’s skillset.

Ability Gaming Enterprise Opposes Invoice

Tempo-O-Matic (POM), the Georgia-based firm that developed the software program of the favored Pennsylvania Ability cupboard, probably the most generally discovered talent sport in Pennsylvania, has lengthy known as for its merchandise to be regulated and taxed. Miele Manufacturing, the Pennsylvania-based manufacturing agency that assembles the terminals, can also be supportive of a authorized framework.

These corporations, nonetheless, say the 35% proposed tax charge on gross talent gaming income advised in SB756 is simply too excessive.

This invoice falls woefully quick,” opined Mike Barley, POM’s spokesperson. Barley stated the invoice as drafted would take crucial cash from small companies which have used the supplemental revenue to maintain folks employed and offset larger prices.

POM and Miele help a tax charge of round 15%. Gov. Josh Shapiro (D), who’s supportive of authorizing talent video games via laws, desires no less than half of the talent sport tax income.

The state’s extremely taxed casinos, which paid tens of thousands and thousands of {dollars} to the state for slots licenses, oppose talent video games on the declare that the unregulated and untaxed terminals poach play from their companies. On line casino slots are topic to a gross gaming income tax starting from 48% to 54%.

Regulation Imminent

A senior authorized official within the Republican Occasion, talking on the situation of anonymity, tells On line casino.org that the forthcoming legalization and taxation of talent video games is a secure wager.

Shapiro continues to hunt new funding to pay for his larger schooling and infrastructure spending, and the state not receiving a dime from the estimated 67K talent video games working within the commonwealth is not going to proceed. Laughlin agrees.

These talent video games are actually all over the place. They’re taking fairly a chew out of the pockets of each our shoppers and our on line casino companies,” Laughlin stated. “Ability video games are undercutting our gaming trade. I’m dedicated to discovering a good, enforceable answer that ranges the taking part in subject.”

SB756 joins Senate Invoice 626 in searching for to manage and tax talent video games. SB626, nonetheless, proposes a significantly decrease efficient talent gaming tax at 16%.