One other Invoice to Restore Playing Deduction Filed in Congress

- Nevada’s congressional delegation is spearheading the restoration of the playing losses deduction

- The One Massive Stunning Invoice trimmed the playing deduction from 100% to 90% for taxpayers

Congress has fielded one more invoice that seeks to revive the playing deduction to 100% for itemized taxpayers.

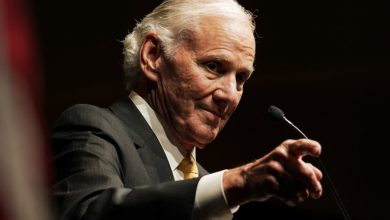

US Rep. Steven Horsford (D) is main laws within the Home of Representatives to revive the playing loss deduction to 100%. Horsford joins his Nevada congressional delegation colleagues in supporting the playing losses repair to the IRS tax code. (Picture: Rep. Steven Horsford)

On Monday, US Reps. Steven Horsford (D-NV) and Max Miller (R-OH) launched bipartisan laws to rectify a tax provision associated to the gaming trade within the One Massive Stunning Invoice (OBBB). A final-minute add-on within the Republicans’ tax regulation omnibus was that starting with the 2026 tax yr, federal taxpayers submitting itemized returns can solely deduct as much as 90% of their playing losses in opposition to their winnings.

Taxing folks on cash they by no means truly earned is essentially unfair and dangerous to Nevada’s financial system,” stated Horsford. “There’s sturdy bipartisan settlement that this provision was a mistake, and Congress should act to right it.”

The 90% cap on playing deductions was affixed to the OBBB whereas the laws was within the Senate Finance Committee. Supporters of the playing deduction restrict say it ensures that high-volume gamblers are assured to pay some type of federal tax.

A number of Laws, Little Motion

Horsford and Miller are behind the FULL Home Act, or the Facilitating Helpful Loss Limitations to Assist Our Distinctive Service Economic system Act. Formally Home Decision 6985, the invoice is a clone of the FULL Home Act within the Senate that Sens. Catherine Cortez Masto (D-NV) and Ted Cruz (R-TX) launched in July.

“Losses from wagering transactions shall be allowed solely to the extent of the good points from such transactions,” the invoice reads.

The FULL Home Acts are along with US Rep. Dina Titus’ (D-NV) FAIR Guess Act. The Truthful Accounting for Earnings Realized from Betting Earnings Taxation Act would additionally restore the playing loss deduction to 100%. The FAIR Guess Act has probably the most help of the three payments, with 23 cosponsors, together with 13 Democrats and 10 Republicans. Horsford and Miller are among the many supporters.

Home Methods and Means Committee Chair Jason Smith (R-MO) has been blamed for stalling the FAIR Guess Act’s consideration.

Because the Senate inserted a provision within the Massive, BS Funds Invoice to decrease the playing loss deduction to 90%, I’ve been main the bipartisan, bicameral effort to right this unfair tax coverage in order that avid gamers shouldn’t have to pay taxes on phantom revenue. Now I’m once more urging Rep. Jason Smith to lastly do what’s proper and embrace a repair within the subsequent Methods and Means Committee markup that protects many livelihoods,” Titus wrote on X.

Although the FAIR Guess and FULL Home Acts have garnered loads of media headlines, neither has been put up for a committee vote. Horsford and Miller’s FULL Home has additionally been directed to the Home Methods and Means Committee.

Retroactive Repair

Ought to FULL Home or FAIR Guess clear Congress and be signed by President Donald Trump, the restoration of the playing losses deduction to 100% can be retroactive, which means the IRS tax code for the 2026 tax yr would come with the total deduction.

“The FULL Home Act is about primary equity within the tax code,” stated Miller. “People shouldn’t be taxed on cash they didn’t truly take residence. By restoring the total deduction for playing losses, this invoice ensures the IRS treats taxpayers truthfully and constantly.”