Illinois Sports activities Betting Tax Leading to Fewer Bets, Extra Income

- Illinois’ per-bet tax is resulting in diminished betting and extra income for the state

- Different states unlikely to observe go well with, says analysis agency

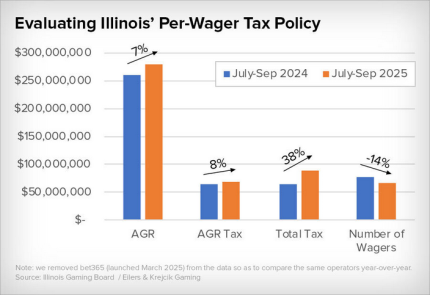

Acknowledging the info needs to be consumed with grains of salt, a analysis agency factors out that since Illinois carried out its per-bet tax plan on web sports activities wagering in July, the variety of bets positioned within the state has declined, however adjusted gaming income (AGR) rose.

The sports activities betting tax improve carried out in Illinois is resulting in fewer bets and extra income for the state. (Picture: Shutterstock)

In a brand new report, Eilers & Krejcik Gaming (EKG) factors out that for the reason that Illinois tax hike went into impact on July 1, and following per-wager transaction charges carried out by DraftKings and FanDuel, the 2 largest US sportsbook operators, the variety of bets positioned within the state has declined, however that hasn’t pinched collected income.

Illinois sports activities wagering and income traits. (Picture: Eilers & Krejcik Gaming (EKG))

Illinois sports activities wagering and income traits. (Picture: Eilers & Krejcik Gaming (EKG))

Final month, the Sports activities Betting Alliance (SBA) of Illinois stated bettors within the state positioned 5 million fewer wagers in September than they did a yr earlier, signaling they’re not happy with the tax or the transaction charges. Knowledge from the Illinois Gaming Board (IGB), nonetheless, verify that September tier-one and tier-two deal with elevated yr over yr.

Illinois Bettors Are Making Fewer Wagers, However …

It’s clear bettors within the Land of Lincoln are decreasing quantity in response to the tax hike, however income isn’t struggling as a result of they’re rising their wager dimension.

First, are noticeably fewer wagers this yr: an unsurprising consequence of assessing a per-wager tax that’s largely handed by means of to clients,” observes EKG. “Second, adjusted gaming income (AGR) nonetheless grew according to the nationwide gross gaming income (GGR) common (+8%), indicating that Illinois clients don’t seem to have downwardly adjusted their wagering exercise to account for the charges however are merely betting extra per wager.”

Underneath the state’s on-line sports activities betting tax scheme, a levy of 25 cents per wager is utilized on the primary 20 million bets booked, with that determine doubling to 50 cents for each wager after 20 million.

That’s significantly onerous for DraftKings and FanDuel, that are the 2 largest operators within the state. Each responded by implementing per-bet transaction charges of fifty cents. Fanatics costs 25 cents per wager in Illinois, whereas different operators opted for elevated minimal wager sizes.

Different States Received’t Copy Illinois, However OSB Taxes Will Rise

For now, Illinois seems to be having its cake and consuming it, too. The variety of bets positioned is declining with no in poor health results on collected income, however the newest tax improve could also be compelling bettors to wager extra, and that might be problematic down the street.

We don’t essentially see different states copying within the close to time period. For one, Illinois has basically incentivized a better stake per wager, which has potential detrimental RG ramifications,” provides EKG.

It’s been extensively mentioned that different states gained’t copy the Illinois tax plan, however the development for sports activities betting taxes goes in a single course: up. Along with Illinois, Louisiana, Maryland, New Jersey, and Washington, DC boosted sports activities wagering taxes in 2025, and a number of other different states proposed will increase of their very own.