Icahn Reveals Caesars Stake Is 2.44 Million Shares

Shares of Caesars Leisure (NASDAQ: CZR) rallied Thursday after Carl Icahn’s Icahn Enterprises (NASDAQ: IEP) revealed its just lately initiated stake within the on line casino operator is 2.44 million shares.

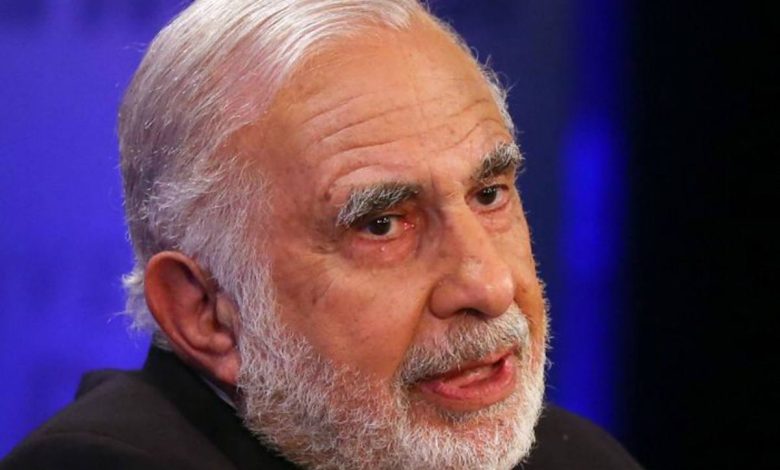

Investor Carl Icahn. His new stake in Caesars is 2.44 million shares, based on an SEC submitting. (Picture: Getty)

To be exact, Icahn owns 2,440,109 shares of the gaming inventory, based on a Form 13F filing with the Securities and Alternate Fee (SEC). Massive cash managers and different skilled buyers are required to publicly disclose fairness stakes 45 days after the tip of the prior quarter so it’s doable that Icahn’s Caesars place has elevated or decreased because the finish of June.

On the finish of Could, Icahn informed monetary media shops that he had amassed a “sizable” place within the Harrah’s operator. “Sizable” is within the eye of the beholder. Caesars has 215.44 million shares excellent, based on Finviz information. Meaning Icahn owns about 1.1% of the gaming firm’s shares excellent.

On a share foundation, that makes Icahn one of many greatest Caesars buyers, although nonetheless outdoors the highest 10. The 2 largest house owners of the shares are Vanguard and BlackRock, which mix to personal 18.67% of the inventory.

Icahn Says He’s Not Contemplating Activism with Caesars

When he revealed his Caesars funding to CNBC in late Could, Ichan stated he’s not contemplating activist motion with the gaming firm, signaling he’s a passive investor and like all of the others in that camp, he’s hoping the gaming inventory will increase in worth.

Nonetheless, his historical past with Caesars can’t be ignored as he’s one of many greatest causes the gaming exists in its present kind. In 2019, Icahn Enterprises took a roughly 10% stake in “previous Caesars,” positioning him to later grow to be the engineer of the $17.3 billion acquisition by Eldorado Resorts — the transaction that created “new Caesars.” Eldorado administration, together with CEO Tom Reeg, now run Caesars. Icahn reportedly has ample respect for Caesars ‘present administration workforce, together with Reeg, and which will have been a few of his motivation for investing within the firm a second time.

One factor is obvious: market contributors view Icahn’s renewed possession of Caesars inventory favorably. Two of the inventory’s finest intraday performances in current months had been the day the financier confirmed the stake and right now when the scale of the funding was made clear.

On that be aware, it’s possible that except Icahn Enterprises purchased Caesars simply days previous to Could 31, it’s holding a place that’s within the crimson. The inventory slumped in April and Could and whereas it’s rebounded off the late Could lows, it nonetheless has work to do to reclaim the second-quarter highs.

Catalysts that May Spark Caesars Inventory

Whereas it’s possible Caesars at present represents a loss for Icahn Enterprises, there are catalysts that would emerge to provoke the shares.

These embody growing profitability within the operator’s digital division, ongoing progress in lowering one of many trade’s largest debt burdens, the Federal Reserve reducing rates of interest, and potential asset gross sales.

Reeg has been constant in his view that the corporate would contemplate divesting casinos it views as “non-core” and those who aren’t producing satisfactory money stream.