Einhorn Lifts Penn Leisure Stake Amid Board Controversy

- DME Capital lifted stake in Penn in first quarter

- Elevated Penn place as one other hedge fund ramped up assaults on board, CEO

Within the first quarter, David Einhorn’s DME Capital Administration elevated its funding in Penn Leisure (NASDAQ: PENN) as one other hedge fund was readying a proxy warfare towards the regional on line casino operator.

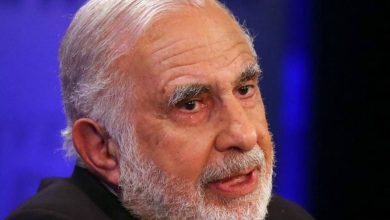

DME Capital founder David Einhorn on the World Collection of Poker. His hedge fund added to its stake in Penn Leisure within the first quarter. (Picture: Institutional Investor)

A kind 13F submitting with the Securities and Alternate Fee (SEC) that was launched after the shut of US markets Thursday signifies Einhorn’s agency boosted its stake in Penn to roughly 6.27 million shares within the first three months of 2025 from about 5.75 million shares. Previously often known as Greenlight Capital, DME Capital initiated its place in Penn within the first quarter of 2024. Thursday’s 13F marks not less than the second time the investor has added to its place within the gaming firm.

At present, Penn is the one gaming inventory within the DME portfolio, and is one in every of only a handful of names the hedge fund added to within the first quarter. The cash supervisor has a monitor document of investing in gaming equities as each lengthy and brief positions.

Large Coincidence in Timing of Einhorn 13F

The regulatory doc confirming DME Capital added to its Penn funding arrived hours after the on line casino operator’s board of administrators despatched a letter to traders, levying allegations and harsh criticism towards HG Vora, the hedge fund that’s waging a proxy warfare towards the gaming firm.

Within the letter, Penn administrators accused Vora of flouting state gaming legal guidelines to land three board seats. The administrators additionally mentioned the hedge fund needed the gaming firm to contemplate a debt-fueled buyback plan that will have required vital, doubtlessly impermissible monetary engineering, including that Vora approached the gaming firm about conducting a strategic evaluation to prepared itself for a sale.

The Penn/Vora controversy is ongoing and will come to a head on the gaming firm’s annual assembly subsequent month when shareholders will determine between the administrators slate proposed by the gaming firm and the “Gold Card” possibility pitched by Vora.

Though it’s clear the Penn/Vora flap didn’t stop DME Capital from including to its Penn stake, it’s not clear how Einhorn feels in regards to the matter. On line casino.org reached out for touch upon the matter, together with an inquiry about how DME will vote subsequent month, however as of this writing, that request for remarks hadn’t been acknowledged.

DME has lowered the typical value it paid for its Penn shares by including to the place amid declines. Its authentic common buy value was $22.69, but it surely’s probably nicely beneath that determine now. The inventory closed at $15.81 on Thursday.

Different 13F Gaming Information

In different 13F information pertaining to gaming shares, Stanley Druckenmiller’s Duquesne Household Workplace considerably elevated its stake in FanDuel mum or dad Flutter Leisure (NYSE: FLUT) within the first quarter to 377K shares from simply 18,100 within the fourth quarter.

3G Capital lowered its stake in DraftKings (NASDAQ: DKNG) within the first three months of 2025. There was additionally some fascinating political information in at this time’s batch of 13F filings.

Soros Fund Administration began a brand new place in Las Vegas Sands (NYSE: LVS) within the March quarter. Investor George Soros and his household are long-time and vital donors to the Democratic get together and its candidates whereas Sands’ largest particular person investor — Dr. Miriam Adelson — is one in every of President Trump’s largest benefactors and a frequent donor to the Republican get together.