Caesars, MGM Most Shorted Shopper Cyclical Shares in August

- Caesars, MGM favourite targets of brief sellers in August

- General bearish bets towards on line casino shares declined final month

Brief sellers sank their enamel into Caesars Leisure (NASDAQ: CZR) and MGM Resorts Worldwide (NYSE: MGM) final month, making the 2 on line casino equities probably the most shorted shopper discretionary shares.

The Las Vegas Strip at night time. Brief sellers laid into Caesars and MGM in August. (Picture: Shutterstock)

Each shares additionally ranked among the many 10 most shorted names within the S&P 500 in August, however that’s a doubtful distinction Caesars received’t have to fret about for the foreseeable future. Earlier this month, S&P Dow Jones Indices stated the Harrah’s operator is one in all three shares being faraway from the benchmark home fairness gauge. That transfer happens previous to the open of US markets on Sept. 22.

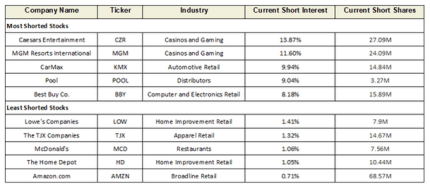

As of the tip of August, bearish merchants had offered brief 27.09 million shares of Caesars, or 13.87% of the on line casino operator’s float. For MGM, 24.09 million shares, or 11.60% of the entire float, had been on mortgage to brief sellers.

A desk displaying Caesars and MGM as probably the most shorted shopper cyclical shares in August. (Picture: Looking for Alpha)

A desk displaying Caesars and MGM as probably the most shorted shopper cyclical shares in August. (Picture: Looking for Alpha)

That was sufficient to make the gaming Goliaths probably the most brief shopper cyclical names final month. No different members of the business ranked among the many prime 5 most shorted shopper discretionary shares and no gaming equities had been among the many 5 least brief shopper cyclical shares as of Aug. 31.

Caesars Typically Attracts Crowd of Brief Sellers

Caesars, which frequently ranks among the many most shorted names within the S&P 500, and different on line casino shares have been favourite targets of bearish merchants this yr for a wide range of causes.

Earlier this yr, it was risky US commerce coverage culminating within the Liberation Day sell-off that prompted shorts to guess towards the likes of Caesars, MGM, and Wynn Resorts (NASDAQ: WYNN). Extra lately, it’s been mounting proof of declining Las Vegas Strip visitation and downbeat second-quarter earnings experiences confirming as a lot.

Each Caesars and MGM had been drubbed in July, however merchants wagering towards the on line casino shares final month needed to take care of rallies — a very noticeable one within the case of MGM. Nonetheless, each gaming equities settled at costs right this moment that had been simply pennies faraway from the Aug. 1 closing prints.

“Bets towards the Casinos, Leisure and Luxurious Items sector as an entire, nonetheless, have declined on the finish of August in comparison with July-end,” in line with Seeking Alpha.

Caesars Shorts Might Quickly Be Uncomfortable

Caesars might be in focus tomorrow as a result of the Federal Reserve is extensively anticipated to unveil its first rate of interest reduce since final November. On Aug. 22, the inventory popped when Fed Chair Jerome Powell implied fee cuts had been on the way in which.

The reasoning is straightforward. Caesars is among the most debt-laden corporations within the business and it’s estimated that for each 100 foundation factors charges decline, the Horseshoe operator might save $60 million in yearly curiosity bills. It’s a scenario Caesars brief sellers are pressured to watch as a result of if President Trump is profitable in forcing Powell out, the following Fed chief is more likely to speed up fee reductions, probably offering ballast to Caesars and different on line casino shares.

“Three fee cuts are our base case underneath a brand new Trump administration-favored Fed chair,” notes Andrzej Skiba, head of BlueBay US fastened earnings at RBC World Asset Administration. “This would possibly finally be seen as inflationary (easing into an enhancing economic system), supporting the argument for a steeper Treasury curve, however that’s a debate for the latter a part of 2026, not one thing we anticipate to drive the markets proper now.”